Mortgage market I. quarter 2024

There is assumed that the situation on the mortgage market will continue to improve in 2024. This improvement started slightly last year and the data for the first quarter of 2024 confirms the recovery of real estate activity in all parameters. The Czech National Bank responds to a series of favorable economic results and stabilization of the price level by further reducing the price of money for mortgages.

The beginning of the year is usually a period of lower activity. The January decrease in the volume of mortgages granted to CZK 11 billion, i.e. by 13%, is therefore not a signal of a change in trend. On the other hand, January inflation reaching 2.3% created further scope for the CNB to reduce the price of mortgage sources. In March, mortgage loans already exceeded CZK 18 billion, and the recovery is still continuing. Inflation has stabilized at the required target of 2.0%, but the CNB is only very cautiously reducing reference rates so far (in March 2T repo rate 5.75%, lombard 6.75%).

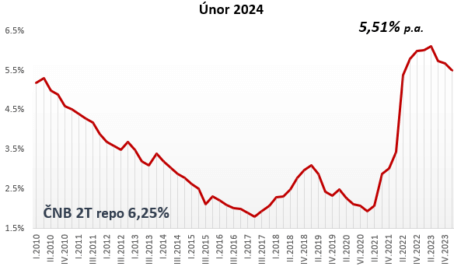

Mortgage index

The mortgage index consisting of interest rates from newly granted mortgages without refinancing reached 5.51% p.a. in February 2024.

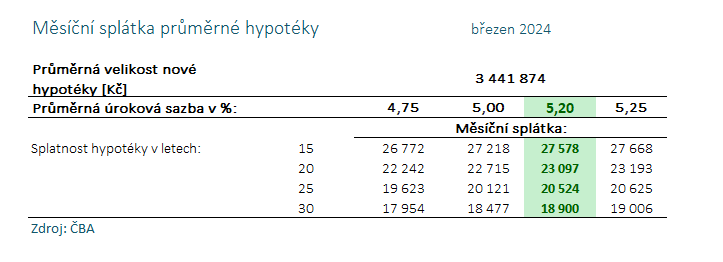

Average mortgage I. quarter 2024: the average mortgage amount increased by CZK 29,452 in the first quarter, when it rose from CZK 3,412,422 in January to CZK 3,441,874 in March. The historically highest average mortgage was reached in November 2021 (CZK 3.46 million), while the lowest level was reached in January 2024 (CZK 2.83 million).

Limitation of long-term fixations

The rates of long-term fixations are stagnant or some banks stop providing them altogether. For example, a 10-year fixed mortgage can currently only be found at MONETy, ČSOB, Raiffeisenbank and ČS, while other banks have decided to remove this product from their offer. The twilight of long-term fixations is a response to the amendment to the Act on Consumer Credit, which determined exactly what sanctions the bank can demand from 1 September 2024 for early repayment by the client.

Mortgage rates spring 2024

The monetary policy of the Czech National Bank creates positive expectations among commercial banks, developers and end clients. Another rate cut will be discussed at the next monetary meeting on March 20, 2024, with the 2T repo rate expected to drop by 0.5 to 0.75%.

This expectation is already beginning to be reflected in the preparation and planning of new real estate projects, bringing more stability and confidence to the mortgage market. This trend is also reflected in the gradual decline of announced, i.e. price, loan rates, which reduces financing costs and supports the availability of mortgage loans for a wider range of clients.

Banks, as part of individual negotiations, are increasingly allowing clients with high creditworthiness to obtain non-public discounts. Traditionally, development projects and loans with a high volume are supported by additional discounts. This trend is observable across the entire financial sector and brings benefits for both parties – banks maintain their competitiveness and clients gain access to more favorable terms for financing their projects.

Bank statistic

The year-on-year growth rate of loans rose from 4.9% in February to 5%, while corporate loans also rose by a tenth of a percentage point to 10.7%, consumer loans (+8.5%) and loans remained unchanged in the year-on-year growth rate for housing (+ 4.2%). Interest in mortgages is rising, the number of new loans agreed is growing, in financial terms from 10.3 billion CZK a year ago to 15.45 billion in March this year.