Czech mortgage market II. quarter 2024

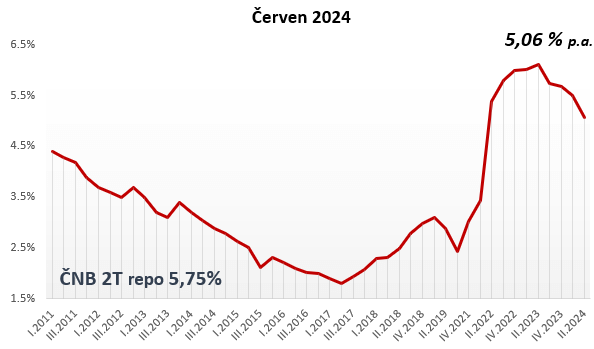

Despite the CNB’s falling rates, mortgages are stagnating. The Czech National Bank has repeatedly responded to the improving economic situation in the Czech Republic by reducing the price of money for mortgages. In the second quarter, it relaxed monetary policy three times in total, when it set the 2T repo rate to 4.75%. Despite this easing, mortgage rates have only fallen cosmetically.

The revival of the real estate market and the increase in the volume of mortgages provided do not create significant competitive pressure on banks. One of the reasons why mortgages do not decrease is the dissatisfaction of banks with the new amount of the penalty for early repayment of the loan in the maximum amount of 1%. Banks are using the current period to increase the risk margin to dissolve the early repayment costs on all clients.

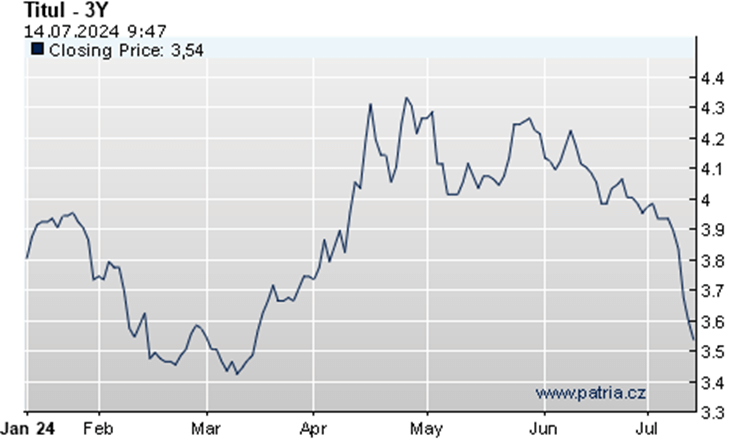

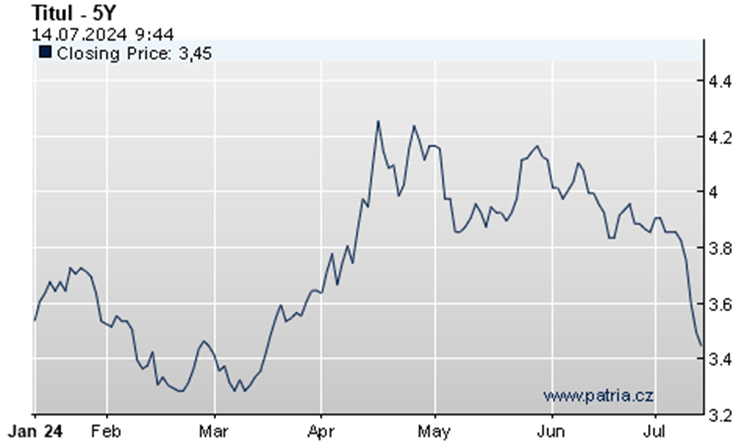

Due to the long-term price of money, more precisely the amount of interest rate swaps for 3 and 5 years, even after the date 1.9.2024, when the banks will apply new sanctions, it is not possible to expect a sharper drop in mortgage interest rates. Interest rate swaps then affect the long-term price of money, while the two-week repo rate has a direct effect especially on 1-year fixes.

source Patria.cz

The recovery of the Czech mortgage market continues

The greatest real estate activity usually occurs in the spring, which also corresponds to the increase in the volume of mortgages provided, when in II. quarter 2024 a total of CZK 69.8 million was provided (April CZK 21.9 million, May CZK 23.7 million, June CZK 24.2 million). These are new mortgages and refinancing of existing loans.

June inflation reaching the target of 2% creates further scope for a reduction in the price of mortgage sources by the CNB, as well as expectations of a decrease in interest rate swaps. According to the representatives of the bank board, we can expect monetary policy to be relaxed at each subsequent meeting until the end of the year. 4 more monetary policy meetings are planned before the end of the year.

Mortgage index

The mortgage index consisting of interest rates on newly granted mortgages without refinancing reached 5.06% p.a. in June 2024.

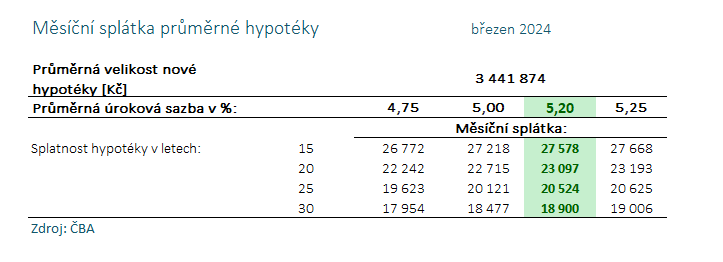

Average mortgage II. quarter 2024: the average amount of the mortgage increased by CZK 298,191 in the second quarter, when it rose from CZK 3,441,874 in March to CZK 3,740,065, breaking the previous record from November 2021 (CZK 3.46 million), on the contrary, the lowest level was reached in January 2024 (CZK 2.83 million).

Limitation of 10 year fixations

The rates of 10-year fixings are stagnant or some banks stop providing them altogether. For example, a 10-year fixed mortgage can currently only be found at MONETA Money Bank, ČSOB, Raiffeisenbank and ČS, while other banks have decided to remove this product from their offer. The end of 10-year fixations reflects an amendment to the Act on Consumer Credit, which established a maximum penalty of 1% for early repayment by the client.

Mortgage rates summer 2024

The monetary policy of the CNB helps to deepen the recovery of the real estate market. Developers are preparing new projects and renewing suspended projects in the field of residential real estate. Banks, which benefit from the increased interest in mortgages, are therefore in no rush to offer significant discounts.

The adopted strategy thus continues to be individual non-public negotiation of rates, which primarily concerns clients with a high credit rating or a requirement for an above-average mortgage. An example of this strategy is the new -0.2 discount at ČSOB for clients with an income higher than CZK 60,000.