Czech credit bank register

In today’s digital economy, ensuring the security and reliability of financial transactions is paramount. Bank register evidence plays a crucial role in verifying transactions, resolving disputes, and ensuring legal compliance. Here’s why it matters and how to maintain it effectively:

Verification: Bank registers provide concrete evidence of transactions, ensuring transparency and trust between parties.

Dispute Resolution: Detailed records help resolve disputes quickly and protect interests in case of discrepancies.

Legal Compliance: Maintaining accurate financial records fulfills regulatory obligations and safeguards against audits.

Transparency: Access to detailed records builds trust with customers, enhancing business credibility.

Creditworthiness: Businesses with well-documented transactions demonstrate financial responsibility, improving their creditworthiness.

Best practices include recording every transaction promptly, ensuring accuracy and detail, regular reconciliation, secure storage, and maintaining a clear audit trail.

In conclusion, bank register evidence is essential for secure credit sales, providing assurance, transparency, and credibility in financial transactions.

Information banks share about clients:

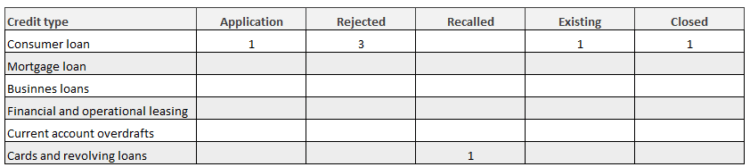

Summary of contracts in evidence:

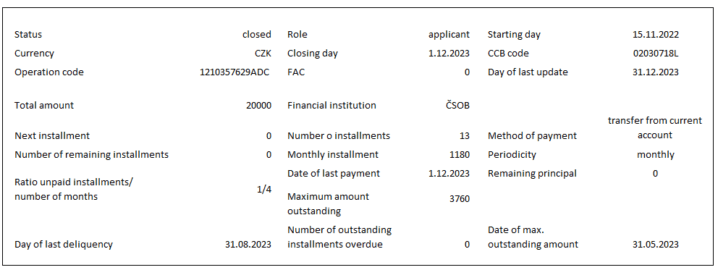

Credit details: