Mortgage interest rates May 2021

Will we see a cooling of the mortgage rally? Before we look at mortgage interest rates in May 2021, let’s summarize the key events of the past few days.

April events in the mortgage market

During the April the mortgage rally broke out in full force, which began during March, when banks provided 14.400 mortgages in a record volume of CZK 44.7 billion. During April, despite rising interest rates, banks were literally flooded with new requests and real estate prices continued to rise. The epidemic began to weaken to which the government responded by presenting a plan to ease epidemic measures. People’s expectations of returning to normal full life have a positive effect on the optimistic behavior. People are trying to use the opportunity when the cheap mortgages are still available.

Mortgage interest rates in May 2021

In May, we expect a further gradual rise in interest rates at most banks. According to the Czech Banking Association, up to 13% of people are planning a new mortgage in the near future. Relieved of the uncertainty of the epidemic, people are now more aware of the deteriorating housing availability. According to the survey, most people expect further interest rates and tighter mortgages, as a result of the CNB’s intervention strengthened by new powers.

In addition, there is still a significant group of retail investors in the real estate market, who, strengthened by the abolition of super-gross wages and “accumulated coronavirus savings”, are looking for additional real estate for rent. More than 25% of the population of the Czech Republic considers investment in residential real estate to be attractive, while approximately half of the population considers the purchase of real estate to be a safe and stable investment. We have also long observed a growing interest in “cottages”, where people flee from large cities to the countryside and invest in the acquisition, reconstruction and expansion of their recreational facilities.

May can be characterized as a month of end of individual discounts, when lending at standard published rates even by large banks, which usually report higher rates, but in the past often offered an additional individual discount.

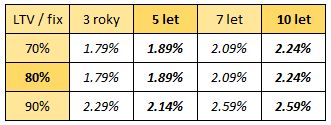

Table of minimal rates May 2021:

source: CNB statistics, own analysis, updated on 1 May 2021

In addition, Hypoteční banka, mBank and Sberbank announce in advance a further increase in interest rates from 3 May 2021 in the amount of +0.2 points.

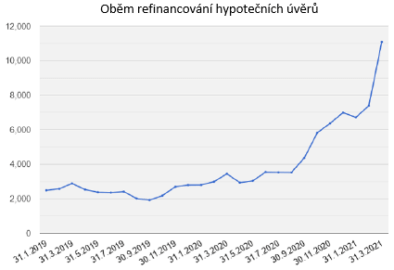

Refinancing

Most banks usually offer interest rates for refinancing previously granted loans with lower rates of 0.1 – 0.2 o against new mortgages. The possibility of verifying the client’s repayment history in bank registers, so in the case of trouble-free repayment, allows banks to reduce the risk premium. Currently, it is possible to obtain a rate of as little as 1.59% p.a. – during May, however, we expect this minimum limit to increase as well.

“Mortgage refinancing is playing an increasingly important role, refinancing reached a new record in April, the monthly volume of refinanced loans was 5 times higher”

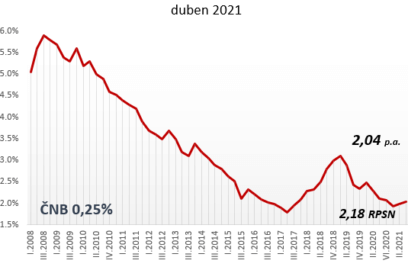

Average mortgage May 2021: CZK 3,009,800, corresponds to an payment of CZK 11,185, at a rate of 2.04% p.a. and maturities of 30 years

Mortgage index April 2021

Composition of the index: the index consists of the arithmetic average of mortgage loan rates provided with 3, 5 and 7 year fixation, the share of loans agreed without additional banking products (life insurance, insurance solvency, credit card, investment) is 80-85%, the share of preferential loans for refinancing reached 35%, the index does not include products of building societies.

(source: statistics of the CNB, CSA and commercial banks)