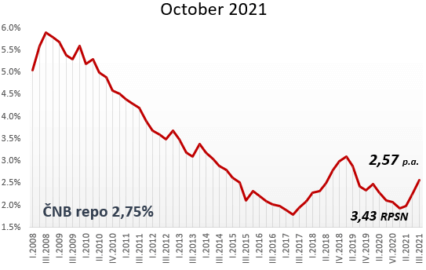

The CNB sent mortgages up on record

Czech National Bank announced an increase of basic repo rate by a record 1,25 points, up to 2,75%. Mortgage loans in Czech will significantly grow up. Bank council has decided to take radical step that has no period in Czech history, because of extreme high inflation rate. The last set value of inflation for October was calculated according to the consumer basket at 4.9%. The expected inflation value will most likely continue to grow min. up to 6%.

Mortgage interest rates in 2022

As today’s increase in CNB rates was expected by banking strategists in the range of 0,5 – 0,75, mortgages may not increase in price by the same amount, as the expected change has already been reflected in the pricing of recent days. Partly in spite of the current price of resources, commercial banks have already been raising mortgage rates in recent weeks, also for strategic reasons, to have room for special discounts during the main season.

However at the beginning of year 2022, we expect that mortgage loans will be provided with rates starting from 4.69 – 5% for standard 3 and 5 year fixations. Buying long-term fixations for 7 and 10 years will no longer make economic sense.

Mortgage repayment growth in 2022

How will be effect changes in practical life? For the model mortgage of CZK 3 million, approaching the average amount, the monthly payment will increase by more than CZK 2.000. The maximum amount of available credit will then decrease by CZK 487.000.

The modeling was calculated for one applicant with a net income of CZK 30.000, without other credit obligations, and the maturity was set at 30 years.

Year 2021

# 3,49% monthly payment CZ 13.455,- max. amount of possible mortgage CZK 3.628.000

Year 2022

# 4,69% monthly payment CZ 15.541,- max. amount of possible mortgage CZK 3.141.000

Mortgage index: