Czech mortgage rates November 2021

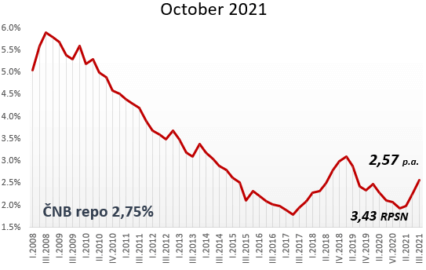

During October interest rates already rose above 3%. Thus, after a significant tightening of the monetary screws, commercial banks ordered a rise in rates.

In the last quarter interest rates rose by as much as 1%, while this average unprecedented change in the average mortgage represents a jump in monthly payment of more than 1000 CZK.

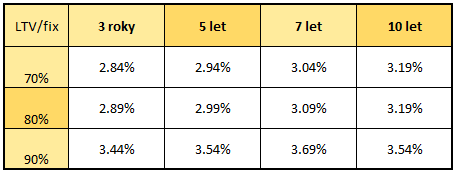

Mortgage interest rates November 2021

At the next meeting of the CNB’s Bank Board, held on Thursday, November 4, 2021, the reference 2W reference rate is expected to increase again by 0.5 percentage points. However, the game also includes a repetition of the last historically most radical jump of 0.75 points. Some economists are already talking about reaching the 4% level for mortgages provided in 2022. Mortgage rates in 2022 should start to provide in the range of 3.8 – 4.1%

End of refinancing

At the same time, with rising interest rates, interest in refinancing previously granted loans with 7, 5 and 3-year fixations is declining. In November, we are witnessing the end of pure refinancing, as the early provision of a favorable rate before the end of the fixation of a running mortgage ceased to make economic sense. The purpose of refinancing will thus mainly fulfill the function of consolidating more loans.

Standard rates November 2021

source: statistic of CNB and CBA, own analysis, update 1. 11. 2021

Refinancing

For refinancing loans, for which the pricing policy consists of a lower margin, a rate of 2,44% p.a. can be obtained for the last time. – during November, however, this minimum limit will also increase at least to 3,29% p.a.

Average mortgage October 2021: CZK 3.283.000, corresponds to an payment of CZK 13.455, at a rate of 2,78% p.a. and maturity of 30 years

Mortgage index

Composition of the index: the index consists of the arithmetic average of mortgage loan rates provided with 3, 5 and 7 year fixation, the share of loans agreed without additional banking products (life insurance, insurance solvency, credit card, investment) represents 80-85%, the share of preferential loans for refinancing reached 30%, the index does not include products of building societies. The level of the index does not show the current situation on the mortgage market, but the situation approximately 2 months ago.