Quick loan for expats

Bank don’t ask what you will use the money for

We apply for a loan together easily and conveniently via the Internet. No paper documentation. After visiting the branch where you will sign the contracts, the bank will immediately send the money to your account. Quick loan is ussualy approved within 24 hours

Credit range: 20.000 to 800.000 Kč

Required documents:

– National passport

– Czech residence card

– Czech ID number “rodné číslo”

– Three bank statements

Main rules to be accepted:

– Provable income in CZK currency (regular monthly salary with tax domicil in Czech Republic, ideally unlimited employment contract or limited empl. contract longer then one year)

Description

Quick loan is credit that is typically used by individuals to finance personal expenses, such as a car, a home renovation, or to pay for education. Bank will open personal bank account to pay

Extra payment is possible

Quick loan can by paid earlier at any thime wihtout fees, client will save future interest.

No Security

There is no requirement for sercurity

Tips: how to avoid beeing rejected by bank:

Anyone can apply for a loan. But it will be obtained only by those who meet the conditions set by the bank or to obtain it. The bank can reject the applicant without giving a reason, there is no right to grant the loan. In these situations bank will always reject the application for credit:

– being in testing period in job

– using overdraft to a bank account – negative balance, late payment

– playing betting and gambling games

– taking sick leave at the time of the loan application

– loan rejection 3 times in a row, 4 applications will be automatically rejected

– missing bank account, having cash income

Quick loan is credit of traditional bank acting on Czech market

How to get loan in Czech as foreginer?

How to get a loan as a foreigner working in Czech Republic?

Living abroad can bring new financial challenges. One of them might be the need for a loan. Obtaining a loan as an expatriate in another country where you work can be challenging, but with some planning and information, it can be achievable. Here are a few steps you can take:

Research Local Banks:

Every bank has its own rules and processes for granting loans to foreigners. Find out which banks or financial institutions are willing to provide loans to foreigners. Our role is to save your time as we regulary collect information about therms.

Employee – Job Contract:

Banks require stability of client’s income and long-therm job contracts. Ideal situation is an employment contract for an indefinite period running at leas one year. However for loan is possible to apply after 3 months.

Loan approval is also possible for a fixed-term employment contract, if is running min. 1 year and if it was min. once extended. For a fixed-term employment contract, there must not be less than 3 months until the end of validity. Salary has to always be send to your bank account. Never accept salary in cash.

Business – Tax declaration:

Getting a loan as a foreign entrepreneur is very difficult, the criteria are much stricter and it depends mainly on the amount of net income after taxation and after deduction of social contributions and health insurance. Banks require at least 2 years of existing business.

Documents and Work Permit:

Most banks will require a valid identity document and proof that you are legally employed in the country where you are applying for a loan. Make sure you have all the necessary documents available. Banks prefer clients with permanent czech residence, however exceptions are possible.

EU citizens:

Although citizens from EU countries can enter the czech labor market without obtaining any residence permit, banks require min. temporary stay. Some banks acept temporary residence only in case you have bank account with salary domicillation min. 6 months.

Non-EU citizens:

Temporary residence: a limited number of banks allows citizens from outside the EU to obtain a loan on the basis of temporary residence. Salary domicillation min. 6 months is required.

Working visa: there is currently only one banks supporting clients with working visa. The maximum maturity period is limited up to 3 years.

Personal ID number “rodné číslo”: absence of personal ID number reduce chance to get loan, therefore ask first the Ministry of the Interior to assign a ID number. Please be aware that social security number or number of health insurance is not the same.

Improve Your Credit History:

To improve your credit history open first small credit, the best way to work on credit history is start by opening credit card or overdarft to bank account. Ideally with limit e.g. 10.000 CZK. Never apply for big loan with long-therm first!

In case you are rejected by bank, never try immidiately apply again in another loan for the loan with the same parametrs. Rejected applications are recorded in the Czech Bank Credit Bueau. Three rejected applications mean stop for next 6 months!

Payment history:

Always pay your obligations on time, bank verify payment history also with non banking providers and Telephone operators (Vodafone, O2, T-Mobile) or Electricity distributors (E.ON Energie, ČEZ, Innogy). You can get a statement with your history from solus.cz

Income – Expenses:

Your income must be sufficient for payment of the loan. After deducting reguraly monthly expenses (e.g. for rent, energies, food, medicaments, phone, internet, kindergarten) there must be sufficient balance for repayment plus reserve. Bank will always deduct minimum amount for life cost.

Compare Offers – APR:

Don’t accept the first offer you receive. Compare different options and terms from various banks and financial institutions to get the best deal for your needs. For comparison is the best way use Annual Percentage Rate (APR), in Czech called RPSN. The APR, or Annual Percentage Rate, represents the total cost of borrowing, incorporating interest and fees, presented as an annual percentage, aiding borrowers in comparing loan offers effectively.

Have Clear Financial Goals:

Before applying, clearly establish how much money you need and how long you will need to repay the loan. This will help you choose the right type of loan and optimize the terms.

Getting a loan in Czech Republic may require some patience and effort, but with good planning and our experiance you can achieve your financial goals.

Czech credit bank register

In today’s digital economy, ensuring the security and reliability of financial transactions is paramount. Bank register evidence plays a crucial role in verifying transactions, resolving disputes, and ensuring legal compliance. Here’s why it matters and how to maintain it effectively:

Verification: Bank registers provide concrete evidence of transactions, ensuring transparency and trust between parties.

Dispute Resolution: Detailed records help resolve disputes quickly and protect interests in case of discrepancies.

Legal Compliance: Maintaining accurate financial records fulfills regulatory obligations and safeguards against audits.

Transparency: Access to detailed records builds trust with customers, enhancing business credibility.

Creditworthiness: Businesses with well-documented transactions demonstrate financial responsibility, improving their creditworthiness.

Best practices include recording every transaction promptly, ensuring accuracy and detail, regular reconciliation, secure storage, and maintaining a clear audit trail.

In conclusion, bank register evidence is essential for secure credit sales, providing assurance, transparency, and credibility in financial transactions.

Information banks share about clients:

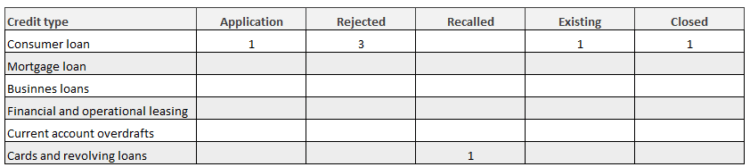

Summary of contracts in evidence:

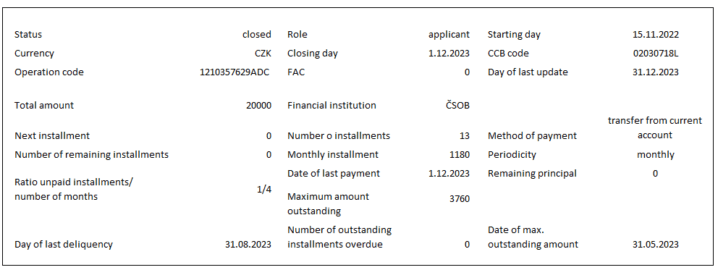

Credit details:

Responsible financing for expats

Looking for the optimal fair play loan for your needs? Look no further and take advantage of our brokerage services! We are your partner in the financial world, opening doors to fair and transparent bank loans.

We provide you exclusive access to loans from multiple banks. Through our partnerships, we can search for the most advantageous offers with optimal conditions for you. With us, you have the opportunity to compare and choose from a diverse range of bank loans without the trouble of gathering information from each bank individually.

Fair and transparent fees are our hallmark. We only collaborate with traditionals banks that share our values of transparency and fair dealings. Forget about hidden costs and predatory practices! With us, you get a bank loan that aligns perfectly with your financial goals and repayment capacity.

Responsible financing

Banking institutions, following responsible lending principles, thoroughly assess an individual’s creditworthiness. Loans are not granted to those who do not meet the prerequisites for regular repayments, such as lacking a stable income or managing multiple loans simultaneously. Reputable lenders refrain from offering loans with excessively high fees for contract closure, account maintenance, early repayment penalties, and more. Unscrupulous practices like blank promissory notes or exorbitant charges for customer service calls are not employed.

In cases where a borrower faces difficulties in repayment, a responsible lender provides guidance, assists in creating a new repayment schedule, or temporarily defers payments.

Opt for simplicity, efficiency, and security. Our brokerage services make it easy for you to find the ideal bank loan. Achieve your goals with us and enjoy worry-free financing provided through our exceptional banking partners!”

We intermediate only credit of traditional bank acting on Czech market

Consumer loan for foreigners

Foreigners, with czech resident or not, can legally get own consumer credit from commercial bank.

Retail banks offer different type of private credits, the most popular are “Consumer loan for anything“, “Loan for housing“, Car credit” and “Consolidation” of old loans. “Mortgage loan„ represents the best product how to finance purchase of real estate property for own living.

Credit range:

Consumer loan for anything – there is no requirement of bank to prove how money will be spent, quick settlement up to 2 days, maximum amount 800.000 CZK, maturity 8 years, thehighest interest rate.

Loan for housing – for investment in the real estate, e.g. for reconstruction, requirement declare purpose of using money, settlement up to 5 days, maximum amount 1 mil. CZK, lower interest rate, maturity up to 10 years.

Consolidation – consolidate several old loans an reduce current expenses in one monthly payment, lower interest rate based on credit history, maturity up to 10 years.

Basic rules:

There is general overview of elementary bank conditions how to get consumer credit, each bank can has additional individul conditions e.g. minimum income.

Basic rules for non-residents to be accepted:

– Provable income in CZK currency (regular monthly salary witch tax domicil in Czech Republic, ideally unlimited employment contract or limited empl. contract longer then one year)

– or be married with czech partner having income in Czech Republic

– or has co-applicant with the income in Czech Republic

The best way how to apply for credit is to use one of the top traditional international bank however some small czech bank can offer individual benefits.

Description

consumer loan is a type of loan that is typically used by individuals to finance personal expenses, such as a car, a home renovation, or to pay for education. Consumer loans can be secured or unsecured, depending on the lender and the borrower’s creditworthiness.

Consumer loans can be obtained from a variety of sources, including banks, credit unions, online lenders, and peer-to-peer lending platforms. The terms and conditions of the loan, including the interest rate, repayment period, and fees, vary depending on the lender and the borrower’s creditworthiness.

Secured consumer loan

A secured consumer loan requires collateral, which is usually an asset such as a house or a car that the borrower owns. If the borrower fails to repay the loan, the lender can seize the collateral to recover their money. An unsecured loan, on the other hand, does not require collateral, but the interest rates tend to be higher, and the borrower’s creditworthiness plays a bigger role in the approval process.

We intermediate consumer loans only from traditional banks acting on Czech market!

Mortgage market 2023

According to the plans announced by the central bankers of the Czech National Bank (CNB) in 2023, the price of money will remain high, resulting in expensive mortgages. The CNB’s strategy is to maintain the 2T repo rate and control high inflation through foreign exchange interventions in the currency market. However, they may reduce the basic rate that directly determines mortgage prices in the third quarter of 2023.

The level of inflation, which reached 16.7% in February 2023, is the crucial factor for determining when to start the reversal. However, the passivity of central bankers makes it unlikely for inflation to improve quickly.

In 2022, the mortgage market activity decreased by over 60%, with financial institutions providing CZK 197 billion in housing loans. However, in December 2022, the year-on-year decline was significant at 82%, with only CZK 7.89 billion provided. According to the Czech Banking Association, the mortgage index, which consists of interest rates on newly granted mortgages without refinancing, reached 5.98% in December.

In the second half of 2022, the financing purposes structure changed, with a greater focus on the reconstruction of existing properties to achieve lower energy demand. Conversely, purchases of flats and family houses dramatically decreased, while refinancing accounted for less than 16% of the total.

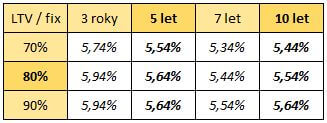

Mortgage interest rates 2023

The monetary stability established by the CNB brings a sense of calm and transparency to the mortgage market, allowing commercial banks to better plan their business goals. Due to high trading margins and a sluggish mortgage market, negotiating discounts will become increasingly important for individuals seeking mortgages.

However, in the long run, mortgage interest rates in the range of 5.5-6.3 % per annum are expected to remain high.

Mortgage index

Average mortgage April 2023:

The average amount of the mortgage fell slightly below CZK 3 million, which reflects falling real estate prices and a stagnant real estate market.

Refinancing

Most banks usually offer interest rates for refinancing previously granted loans with lower rates against new mortgages. The ability to verify the client’s history allows banks to reduce the trading margin. It is currently possible to get rates from 5.59% p.a.

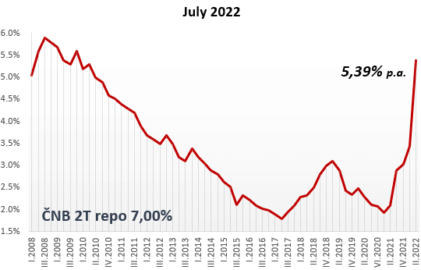

Mortgage market June 2022

The fall of the Czech mortgage market continues, the volume of mortgages granted in May increased slightly by 3.4% compared to April, but this seasonal growth is normal for May. Housing loans worth CZK 40.555 billion were provided in May, however, in a year-on-year comparison, the overall decrease remains around 60%.

The further cooling of the mortgage market reflects the significant tightening of the CNB’s monetary policy. At the last meeting of the bank board on 22.6. was decided on a draconian increase of the reference 2T repo rate by 1.25 percentage points, i.e. a change from 5.75% to 7.00% (corresponding to 1999 values).

Mortgage interest rates June 2022

The 7% threshold was already exceeded for the first time, so far only for 1 and 3 year fixations. However we can assume that bank offers will increasingly start at 7% even for longer-term fixations.

mBank was the first to even announce that the 8% threshold had been exceeded, i.e. for 1 and 3 year fixations for the time being. However the differences between the banks are deepening, and mBank with its approximately 2% market share is definitely not setting the trend for mortgages.

Most bankers expect rates to peak this year and predict a decline early next year. From July 1, 2022, the CNB will be managed by a changed bank board headed by Governor Aleš Michl, from whom many economists hope for a dovish change in course, i.e. a gradual end to the tightening of monetary policy. We will see if the development of the economic situation in the coming months will allow the new governor to turn the imaginary rudder.

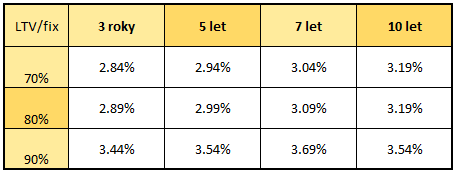

Standard interest rates June 2022

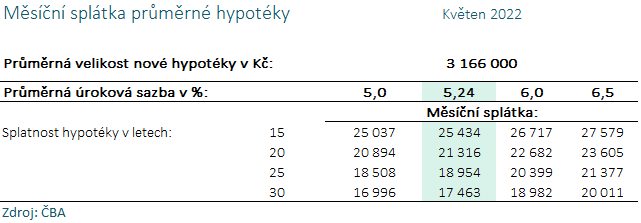

Average mortgage May 2022: the average amount of the mortgage in May remained almost unchanged, i.e. 3,166 thousand. CZK, but the average monthly mortgage payment increased.

Refinancing

Most banks usually offer interest rates for refinancing previously granted loans with lower rates against new mortgages. The ability to verify the client’s history allows banks to reduce the trading margin. It is currently possible to get rates from 5.34% p.a.

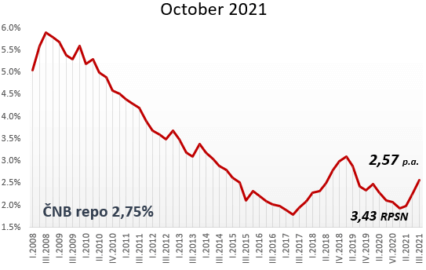

The CNB sent mortgages up on record

Czech National Bank announced an increase of basic repo rate by a record 1,25 points, up to 2,75%. Mortgage loans in Czech will significantly grow up. Bank council has decided to take radical step that has no period in Czech history, because of extreme high inflation rate. The last set value of inflation for October was calculated according to the consumer basket at 4.9%. The expected inflation value will most likely continue to grow min. up to 6%.

Mortgage interest rates in 2022

As today’s increase in CNB rates was expected by banking strategists in the range of 0,5 – 0,75, mortgages may not increase in price by the same amount, as the expected change has already been reflected in the pricing of recent days. Partly in spite of the current price of resources, commercial banks have already been raising mortgage rates in recent weeks, also for strategic reasons, to have room for special discounts during the main season.

However at the beginning of year 2022, we expect that mortgage loans will be provided with rates starting from 4.69 – 5% for standard 3 and 5 year fixations. Buying long-term fixations for 7 and 10 years will no longer make economic sense.

Mortgage repayment growth in 2022

How will be effect changes in practical life? For the model mortgage of CZK 3 million, approaching the average amount, the monthly payment will increase by more than CZK 2.000. The maximum amount of available credit will then decrease by CZK 487.000.

The modeling was calculated for one applicant with a net income of CZK 30.000, without other credit obligations, and the maturity was set at 30 years.

Year 2021

# 3,49% monthly payment CZ 13.455,- max. amount of possible mortgage CZK 3.628.000

Year 2022

# 4,69% monthly payment CZ 15.541,- max. amount of possible mortgage CZK 3.141.000

Mortgage index:

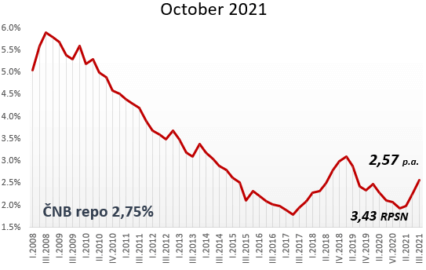

Czech mortgage rates November 2021

During October interest rates already rose above 3%. Thus, after a significant tightening of the monetary screws, commercial banks ordered a rise in rates.

In the last quarter interest rates rose by as much as 1%, while this average unprecedented change in the average mortgage represents a jump in monthly payment of more than 1000 CZK.

Mortgage interest rates November 2021

At the next meeting of the CNB’s Bank Board, held on Thursday, November 4, 2021, the reference 2W reference rate is expected to increase again by 0.5 percentage points. However, the game also includes a repetition of the last historically most radical jump of 0.75 points. Some economists are already talking about reaching the 4% level for mortgages provided in 2022. Mortgage rates in 2022 should start to provide in the range of 3.8 – 4.1%

End of refinancing

At the same time, with rising interest rates, interest in refinancing previously granted loans with 7, 5 and 3-year fixations is declining. In November, we are witnessing the end of pure refinancing, as the early provision of a favorable rate before the end of the fixation of a running mortgage ceased to make economic sense. The purpose of refinancing will thus mainly fulfill the function of consolidating more loans.

Standard rates November 2021

source: statistic of CNB and CBA, own analysis, update 1. 11. 2021

Refinancing

For refinancing loans, for which the pricing policy consists of a lower margin, a rate of 2,44% p.a. can be obtained for the last time. – during November, however, this minimum limit will also increase at least to 3,29% p.a.

Average mortgage October 2021: CZK 3.283.000, corresponds to an payment of CZK 13.455, at a rate of 2,78% p.a. and maturity of 30 years

Mortgage index

Composition of the index: the index consists of the arithmetic average of mortgage loan rates provided with 3, 5 and 7 year fixation, the share of loans agreed without additional banking products (life insurance, insurance solvency, credit card, investment) represents 80-85%, the share of preferential loans for refinancing reached 30%, the index does not include products of building societies. The level of the index does not show the current situation on the mortgage market, but the situation approximately 2 months ago.

Mortgage interest rates May 2021

Will we see a cooling of the mortgage rally? Before we look at mortgage interest rates in May 2021, let’s summarize the key events of the past few days.

April events in the mortgage market

During the April the mortgage rally broke out in full force, which began during March, when banks provided 14.400 mortgages in a record volume of CZK 44.7 billion. During April, despite rising interest rates, banks were literally flooded with new requests and real estate prices continued to rise. The epidemic began to weaken to which the government responded by presenting a plan to ease epidemic measures. People’s expectations of returning to normal full life have a positive effect on the optimistic behavior. People are trying to use the opportunity when the cheap mortgages are still available.

Mortgage interest rates in May 2021

In May, we expect a further gradual rise in interest rates at most banks. According to the Czech Banking Association, up to 13% of people are planning a new mortgage in the near future. Relieved of the uncertainty of the epidemic, people are now more aware of the deteriorating housing availability. According to the survey, most people expect further interest rates and tighter mortgages, as a result of the CNB’s intervention strengthened by new powers.

In addition, there is still a significant group of retail investors in the real estate market, who, strengthened by the abolition of super-gross wages and “accumulated coronavirus savings”, are looking for additional real estate for rent. More than 25% of the population of the Czech Republic considers investment in residential real estate to be attractive, while approximately half of the population considers the purchase of real estate to be a safe and stable investment. We have also long observed a growing interest in “cottages”, where people flee from large cities to the countryside and invest in the acquisition, reconstruction and expansion of their recreational facilities.

May can be characterized as a month of end of individual discounts, when lending at standard published rates even by large banks, which usually report higher rates, but in the past often offered an additional individual discount.

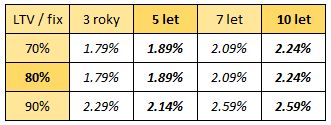

Table of minimal rates May 2021:

source: CNB statistics, own analysis, updated on 1 May 2021

In addition, Hypoteční banka, mBank and Sberbank announce in advance a further increase in interest rates from 3 May 2021 in the amount of +0.2 points.

Refinancing

Most banks usually offer interest rates for refinancing previously granted loans with lower rates of 0.1 – 0.2 o against new mortgages. The possibility of verifying the client’s repayment history in bank registers, so in the case of trouble-free repayment, allows banks to reduce the risk premium. Currently, it is possible to obtain a rate of as little as 1.59% p.a. – during May, however, we expect this minimum limit to increase as well.

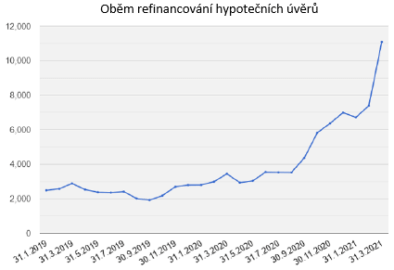

“Mortgage refinancing is playing an increasingly important role, refinancing reached a new record in April, the monthly volume of refinanced loans was 5 times higher”

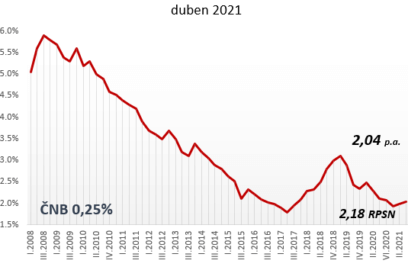

Average mortgage May 2021: CZK 3,009,800, corresponds to an payment of CZK 11,185, at a rate of 2.04% p.a. and maturities of 30 years

Mortgage index April 2021

Composition of the index: the index consists of the arithmetic average of mortgage loan rates provided with 3, 5 and 7 year fixation, the share of loans agreed without additional banking products (life insurance, insurance solvency, credit card, investment) is 80-85%, the share of preferential loans for refinancing reached 35%, the index does not include products of building societies.

(source: statistics of the CNB, CSA and commercial banks)

Czech mortgage rules

Basic 3 rules of czech bank for non-residents to be accepted.

If you want apply for mortgage loan in the Czech Republic you have to fulfill at least one of the following conditions:

- Provable income in Czech (stable salary or own business)

- or be married with czech partner having income in Czech

- or has czech partner (childern, parents) with the income in Czech

Abolition of real estate tax on housing units

Housing units in family houses will be exempt from real estate transfer tax. On 8 October 2019, the President of the Republic signed an amendment to the Act regulating the acquisition of flats in family houses. Newly, the buyer saves 4% on the purchase of an apartment in a family house.

Currently, the tax is not paid for the first acquisition of a new family house or apartment in an apartment building. Nor is it paid for the free transfer of real estate in the form of a donation or inheritance.

Due to the “discrimination” of housing units in family houses, the legislation was unified. This will now also apply to the first acquisition of housing units in family houses. The family house can then have a maximum of three housing units in order to benefit from the exemption.

The amendment will come into effect after its publication in the Collection of Laws. Unfortunately, for other types of real estate, the tax liability remains unchanged despite the efforts of some politicians.

How to get mortgage in Czech?

Do you want to buy flat or build your own house in Czech Republic? Do you need take a loan from Czech bank? Here is overview of the basic legal conditions required by Czech National Bank (CNB). These rules are universal for everybody despite you are Czech citizen or not.

Mortgage rules:

1) Object of purchase: flat, family house, apartment house, cottage or building land,

2) Loan to Value can be max. 80%,

3) Own savings: 20% of your own money you have to invest first,

4) Debt Service To Income: max. 45% monthly payment of loan vs. your’s net income,

5) Debt To Income: max. 9x – total loan vs. early net income,

6) Scoring of bonity: positive stable sufficient income, no negative history about previous loans.

Recomended steps how to stay on safety side and has situation under control:

1) Ask your mortgage broker to prepare credit offers and compare coditions,

2) Asko your broket to do scoring of bonity in bank before signing reservation contract with real estate company,

3) Let do valuation of house or flat you want to use as bank quarantee (pledge) by bank technician,

3) Reservation contract with real estate agency can be signed,

3) Let check purchase contract, therms and conditions of widrawing money has to be usualy adjusted with a bank,

4) Mortgage loan will be approved by bank and shall be signed,

5) Signing purchase contract at a notary office,

6) Signing pledge contract at a notary office.

Need more explanation of above terms? Or need to know your scoring? Please contact us by form.